At the time of this writing, the markets are positive since Russia invaded Ukraine. This rebound fits with the previous wartime events over the past few decades. That is not to say that the market will continue to go up from here. We don’t know the future, and the situation in Ukraine is fragile. If the conflict spills over to a NATO country, that could certainly change the dynamic of US involvement and economic and market implications.

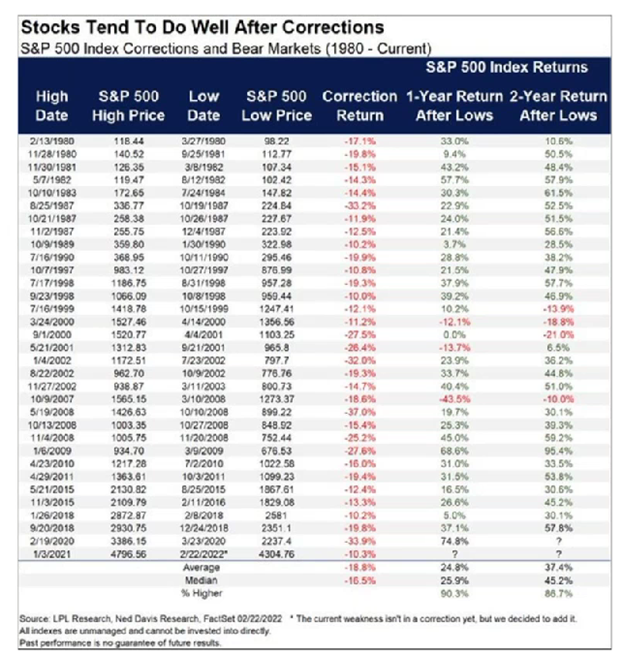

Last week we looked at how markets tend to respond to geopolitical events. This week let’s look at how the market tends to respond after going into a correction (as we are in now). There are a couple of things that stand out to me on this chart:

- How many times the S&P 500 has gone into correction territory,

- The 1-yr and 2-yr returns following the correction.

As you can see, most of the time forward returns after a correction are not just positive, but much higher than average. In these cases, “buying the dip” would pay off handsomely. However, there are a few times when the forward returns are not good. Those, not surprisingly, occurred when the US was either in or heading to a recession.

Therefore, we put a lot of emphasis on the potential for recession. At this point, we are still constructive on the US economy and do not believe that we are heading for a recession immediately. There are signs that the economy is deteriorating, and we have probably reached maximum growth and corporate profits, but that doesn’t mean that we are going into recession soon.

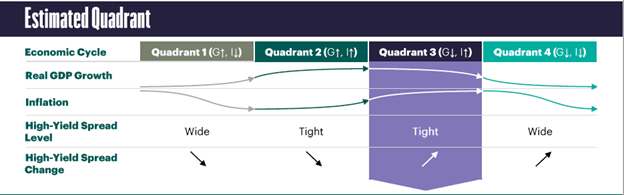

Here is a graphic from a hedge fund manager we track, Verdad Advisors. They break the economic cycle into 4 quadrants. Quadrant 1 is during a recovery phase, Quadrant 2 is the growth phase, Quadrant 3 is the mature phase, and Quadrant 4 is recession. They believe that we are currently in Quadrant 3 – Slowing Growth and Higher Inflation.

This phase can last months or years; so again, it doesn’t tell us that a recession is imminent, but it does seem that we are closer to the end of the economic cycle.

If the last two years have taught us anything, it is that things can change quickly. We will keep a close eye on economic and market data.

Sources: Taiber Kosmala, Verdad Advisors