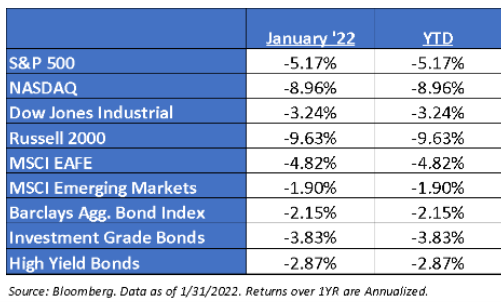

We’ve seen big moves in equities to start the year. This was the worst January for the S&P 500 since 2009 while at the same time it’s been the best start to the year for Value stocks in decades. We expect market volatility to remain high and headline-driven for a while longer.

Expect More Volatility

The new year is certainly off to a volatile start. The huge month-end rallies continued a trend of big swings that has defined markets since the Federal Reserve signaled its intention to tamp down inflation that had swelled to the fastest since the early 1980s. In one session, the Nasdaq 100 erased a loss of almost 5%, while the S&P 500 staged three straight days with swings that topped 3%. Markets are finding themselves in a tug of war between strong earnings and economic growth, and the specter of the Fed raising rates. And not to mention a normalization of egregious valuations.

Last Thursday we saw another eye-popping inflation number as the CPI hit 7.5%. This has sent fears through the stock and bond market, with equities selling off and 10-year bond rates rising. The good news is that corporate earnings continue to come in strong for most companies. We may see this back-and-forth between markets weighing the strong earnings versus the high inflation numbers for a while.

Sources: Aptus Capital Advisors, Bloomberg, Yahoo Finance

This material is prepared by Optivise Advisory Services, LLC and/or its affiliates for informational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. This material may only be distributed in its original format and may not be altered or reproduced without the prior written consent of Optivise. The opinions expressed reflect the judgement of the author, are as of the date of its publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by Optivise to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Optivise, its officers, employees, or agents.

This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections, and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. All investment strategies have the potential for profit or loss. All strategies have different degrees of risk. There is no guarantee that any specific investment or strategy will be suitable or profitable for a particular client. The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy.